Friday, 30 December 2011

The Scourge of Unnecessary Usernames

The signup process for a website needs to be as smooth as possible. You’ve got a user to the point where they’re about to sign up. You've mastered the art of lazy registration. Every field you add in a signup form is one more reason for user abandonment. So why is it that many sites still prompt you for a username as well as an email address when signing up?

We've all been there. I guess most of us have a standard username we like to use in these situations. john, oh it’s gone, lets try johndoe, nope that’s gone too, john2148 it is then. Will be sure to remember that one next time round.

In most cases there's no need to force users to come up with a username, since there’s already a unique identifier they've already memorised - their email address. Chances are you’re going to ask them for this anyway.

The only reason to ask for a username in addition to an email address is if you plan to publicly display this on your site (e.g on a forum). Here it makes some sense, but even this could be accomplished by using the email address for login and allowing the username to be an alias (unique and unchangeable if necessary).

It’s possible that people may want to have multiple accounts, but for most applications this is unlikely or even undesirable. In cases where people e.g. need a work account and a personal account, they’ll probably have corresponding emails.

One other option is doing away with passwords altogether, especially where the site is one that will be used rarely (e.g. travel insurance). In cases like this you could just request an email address when users want to login and send them a link which allows one-off access to a time-limited session. If your password reset procedure only requires access to the user’s email address then you lose no security by doing this.

Of course, if you do away with usernames, you need to think about how to deal with people that have lost access to their email addresses (e.g. if they used a work address for a personal service). But depending on the size of your userbase, this may happen infrequently enough that you can handle it manually.

The other increasingly popular mechanism is to allow people to login with a 3rd party service like their Facebook or Twitter account. This is a great idea, especially if you want to encourage people to use their real identities, but in most cases you’ll still need to offer the option of a local login to avoid losing users that don’t have or are unwilling to use such services.

So please, let's just do away with unnecessary usernames.

Monday, 12 September 2011

How Apple are storming the enterprise from the inside

Earlier this year I was working with a company that was in the throes of trying to put together a mobility strategy. In truth they already had a mobility strategy - employees had laptops with access to a VPN for when they were using public wifi. Blackberrys were the phone of choice, and OWA let employees gain access to email from non-company computers. Sounds like mobility was pretty well covered, no?

This would have been fine except for one little thing. Employees were asking questions about iPhones. Some had discovered that asking the right person in the networking team would reveal a little known publically accessible IMAP server that would let them get company email on their iPhone. When the IT department decided to enforce policy and shut this down, there was an uproar.

The more enterprising sales reps were starting to bring in their own iPads loaded with company demos and presentations to sales meetings. Others started following suit when they noted competitors doing the same. In a chat with a national sales director, he mentioned that with many customers, turning up with an iPad definitely made a positive impression, and he was keen to see an official solution put in place.

Since then I've seen this same story repeat itself at a couple of large companies, especially with the iPad. Whereas most of the functionality of the iPhone can be matched by a Blackberry (at least for business purposes), the iPad stands head and shoulders above the competition. Moreover, many employees have positive personal experience of using the iPad, so it's a natural extension to bring one in to work, much like a favoured pen or notepad.

The typical concerns around Apple technology in IT departments tends to centre around security risks. How do we manage access? Can we remotely wipe them if they are lost or if an employee is terminated? Can we restrict the types of applications that can be installed? RIM with their combination of BlackBerry enterprise server (BES) and the ubiquitous BlackBerry devices have long held sway over this market with ready answers to all of these questions. Now with the help of various partners, Apple seems to be attacking these concerns head on.

It's tough to see how RIM can compete effectively. Certainly the promise of flash on the BlackBerry Playbook isn't enough. In fact it rarely even comes up as a concern.

Enterprise software vendors also seem to know which way the wind is blowing, and many seem to be focussing on an Apple iOS first strategy, or even an iOS only strategy. Some are hedging their bets by sticking to cross platform HTML5 apps, and it's not yet clear how this will play out compared to native applications in the long term. Very few software companies are leading with a BlackBerry app first.

It's a testament to Apple's design excellence that they've managed to transform their consumers into enterprise salesmen. Nowadays for most CIOs, the question isn't really one of whether iOS devices should be allowed within the enterprise, but rather how best to deal with the inevitability of their arrival.

You might wonder where Android devices fit in to all of this. Perhaps the lack of a single clear competitor to the iPhone and iPad is the problem, but for whatever reason, the clamour seems to be for IOS devices rather than simply for non-RIM devices. It's possible that the demand for iOS devices might lead to a multi-platform enterprise rather than a future where we simply swap the RIM hegemony for an Apple one. BlackBerry devices will no doubt have many loyal adherents who will be loathe to give up their cherished keyboard, and thus a more inclusive mobility policy may be a likely solution, which would be to the benefit of Android manufacturers as well as Apple.

This would have been fine except for one little thing. Employees were asking questions about iPhones. Some had discovered that asking the right person in the networking team would reveal a little known publically accessible IMAP server that would let them get company email on their iPhone. When the IT department decided to enforce policy and shut this down, there was an uproar.

The more enterprising sales reps were starting to bring in their own iPads loaded with company demos and presentations to sales meetings. Others started following suit when they noted competitors doing the same. In a chat with a national sales director, he mentioned that with many customers, turning up with an iPad definitely made a positive impression, and he was keen to see an official solution put in place.

Since then I've seen this same story repeat itself at a couple of large companies, especially with the iPad. Whereas most of the functionality of the iPhone can be matched by a Blackberry (at least for business purposes), the iPad stands head and shoulders above the competition. Moreover, many employees have positive personal experience of using the iPad, so it's a natural extension to bring one in to work, much like a favoured pen or notepad.

The typical concerns around Apple technology in IT departments tends to centre around security risks. How do we manage access? Can we remotely wipe them if they are lost or if an employee is terminated? Can we restrict the types of applications that can be installed? RIM with their combination of BlackBerry enterprise server (BES) and the ubiquitous BlackBerry devices have long held sway over this market with ready answers to all of these questions. Now with the help of various partners, Apple seems to be attacking these concerns head on.

It's tough to see how RIM can compete effectively. Certainly the promise of flash on the BlackBerry Playbook isn't enough. In fact it rarely even comes up as a concern.

Enterprise software vendors also seem to know which way the wind is blowing, and many seem to be focussing on an Apple iOS first strategy, or even an iOS only strategy. Some are hedging their bets by sticking to cross platform HTML5 apps, and it's not yet clear how this will play out compared to native applications in the long term. Very few software companies are leading with a BlackBerry app first.

It's a testament to Apple's design excellence that they've managed to transform their consumers into enterprise salesmen. Nowadays for most CIOs, the question isn't really one of whether iOS devices should be allowed within the enterprise, but rather how best to deal with the inevitability of their arrival.

You might wonder where Android devices fit in to all of this. Perhaps the lack of a single clear competitor to the iPhone and iPad is the problem, but for whatever reason, the clamour seems to be for IOS devices rather than simply for non-RIM devices. It's possible that the demand for iOS devices might lead to a multi-platform enterprise rather than a future where we simply swap the RIM hegemony for an Apple one. BlackBerry devices will no doubt have many loyal adherents who will be loathe to give up their cherished keyboard, and thus a more inclusive mobility policy may be a likely solution, which would be to the benefit of Android manufacturers as well as Apple.

Wednesday, 17 August 2011

Transactional email should be fast

A few weeks ago I needed to renew an insurance policy online. Inevitably, I'd forgotten the password so I clicked the reset password link and tabbed over to my inbox to pick up the email. Nothing there. Click to refresh a few times. Still nothing. Read some other emails that catch my attention and head back to inbox. Zilch. Head back to website and click password link a few more times for good measure. Check spam folder. Lots of Viagra offers but no insurance password reset. Give up and go outside to enjoy the sunshine.

Check my phone later that evening, and see that the password reset finally turned up. In this case I didn't end up going to a competitor or abandoning the purchase altogether, but one can imagine that delay in sending email reminders could easily translate into website or shopping cart abandonment.

I'd mostly forgotten about this incident and wouldn't have bothered writing about it, except that a similar thing happened again today, this time with an application that I was installing on my laptop. The user set up process required me to click on an activation link - pretty standard stuff. Once again, heading to my inbox showed nothing for a good hour or so.

If you're going to make email an integral part of interactive user process, then it must be immediate. Although you can't guarantee the entire end-to-end delivery, in this day and age there's no excuse for any holdups to occur on your end. Tools like SendGrid, Postmark, or Amazon SES make transactional email a breeze. Measure performance of email delivery just as you'd measure performance for the rest of your application. You wouldn't expect a user to wait 30 minutes for a page load; don't make them wait for email either.

Tuesday, 26 July 2011

B2B enterprise sales, a view from the inside

I've recently been doing some consulting work for a large multinational, helping them select a CRM product and vendor. In the interests of confidentiality, I won't say too much about the client or the vendor, but I hope the following inside view might help startups working on B2B sales. Mostly this relates to large scale software sales (supported by services), but much of it will apply to smaller scale items and pure services too.

Timescale and budgets

Almost everything in large companies takes a long time. Enterprise sales is no exception. In particular for significant expenditure, departments need to include it in their budget, which may only be set yearly. Additional spend not on the budget will always be a harder (but not impossible) sell. Depending on the overall amount, various levels of approval need to be sought, potentially up to board level. Breaking up your sale into smaller pieces may avoid some of this. For initial one-off costs you may also be able to get money from budgets set aside for discretionary spending.

TCO

Total Cost of Ownership (TCO) is the name of the game. Whilst you might be focussed on your per-seat price (which is of course important), the buyer is really focussed on the total cost. In particular this includes the cost to implement, cost of maintenance and support costs. Customers can be paranoid about "hidden" costs that become significant over the lifetime of the project. Typical enterprise systems are expected to have 5-year lifetimes, and it's the TCO over this period that is relevant. Costs will also need to be broken down to help determine what can be capitalised, what can be re-charged to departments/subsidiaries etc.

RFPs/RFIs

Usually seen in a competitive tendering situation, Requests for Proposals (RFPs) and their pre-cursor, Requests for Information (RFIs), are often a necessary evil. Ideally you want to be able to avoid these altogether, but often for any large scale purchase, governance requirements mean that you will have to deal with them. In some cases these can be a bit of a sham, where there is a strong "default" decided in advance and the rest are just there to make up the numbers and provide negotiating leverage. In the case I was working on, the entire vendor selection process was taken very seriously internally, with the decision still open right to the very end. As a vendor it's hard to know which of the two situations you're in so best to always take it seriously until you get a definite signal (inside knowledge etc) to tell you otherwise.

In the worst case the customer produces a heavy document laden with unrealistic expectations, and the respondents answer "yes" to every requirement whilst shovelling in a good dose of marketing and sales copy wherever they can. There are usually faults on both sides, but on the sales side I would suggest

- Understand that answering "no" for things you just can't or won't do is perfectly fine and comes across as much more honest than somebody that says they can do everything (unless of course they can, say in the case of a relatively simple RFP). Feel free to suggest alternative options and 3rd party partnerships if appropriate.

- Don't cut and paste irrelevant marketing blurb. We understand that you have stock answers to questions that you see all the time, and copying answers from a previous RFP response is perfectly fine - if they are relevant. Also have the decency to check it once over and remove any mention of the previous client's name that made it through the cut and paste. I've seen this happen more than once and it looks pretty unprofessional.

- Know who your competitors are, and position your answers accordingly. However don't make the mistake of trying to be something you're not and be wary of actively trashing the opposition - it rarely comes across well. It's generally better to play to your own strengths rather than your opponents weaknesses. Try not to overdo it with the sales patter.

One throat to choke

Often companies want to contract with just a single party who is then responsible for all subcontracts (integration partners, additional 3rd party software etc). It's best to be flexible on this in case they want a mixture of the two approaches.

Users are not always the buyers

In our case, one of the vendors had a product which had a more attractive UI. If it were down to just the users, they would have picked this one. Ultimately this vendor wasn't selected because the another solution had a good enough UI and did much better on other fronts. Not to say that user opinion didn't matter - ease of user adoption was a success criteria for us, but it's important to understand all of the decision criteria involved.

Price negotiationsEnterprise buyers always expect a discount. We had a procurement department involved that was responsible for the commercial negotiation. Typically the way it works is that vendors show their prices at a "Card rate" and then offer various discounts. The client will then negotiate further discounts over the offered discounts. If it seems like a silly game, it is. But unless you have market power and the client has no alternatives (e.g. you are Microsoft), you will have to play by the rules of the game.

Several books have been filled with advice on negotiation. So I won't go into this in any more detail beyond recommending that you go in well prepared with a negotiation plan.

Cloudy skies

Companies are paranoid about data being in the cloud, but there is a gradual acceptance that this is the way things are going. If you're peddling a SaaS product, anything you can do to allay fears will help. Expect questions about your data centres and SAS70 compliance. In particular European companies can be wary of having data hosted in the US, even with the Safe Harbor agreement in place. Customers may request data centre visits/audits.

Also think about how integration will work through firewalls and how you will deal with authentication (single sign-on with MS Active Directory etc).

Know your product

Enterprise buyers are used to dealing with salesmen and will spot when you don't really know what you're talking about. Nobody expects salesmen to know every facet of their product, but customers will expect to be able to talk to somebody who can fill in the holes where necessary. Bringing in somebody from product or engineering who really knows the nuts and bolts demonstrates the substance behind the spin. Live demos are great too.

Reference customers

Reference customers are an incredibly powerful sales tool. If you can present customers that are evangelical about your product and services, this goes a long way. Ultimately this relies on you building good product and providing great customer service. Getting new customers to agree to be future reference customers (case studies, joint press release, reference calls etc) is a good negotiation ask which comes at zero cash cost to the customer.

Current big name customers, or customers from the same industry will help inspire confidence, and possibly even a fear of being left behind. If your company or product is new to the market, this will help re-assure potential customers that they are not taking a huge gamble.

Contract negotiations

Once the deal is sealed and you've agreed key commercial terms, there's usually a period of detailed combing over of contracts. It's unlikely that this will uncover a deal breaker - usually by this time the customer has mentally committed to selecting you so just bear with it and get through to the other end.

Whatever happened to the consumerisation of IT?

Yes, I know Salesforce.com managed to get into organisations by getting users to whip out their credit cards and buy the product themselves. But this really isn't a strategy you can rely on, and even Salesforce still go through the whole rigmarole outlined above when dealing with big sales. If you're selling e.g. a tool for developers then the process should be much less complex, but for anything that will affect large numbers of users, I'm afraid IT procurement really hasn't changed much in the past 20 years. Ben Horowitz has a great blog post on this here.

If any of you have stories or advice on the enterprise software sales process (from either side of the fence), I'd love to hear them.

Follow me on twitter

Saturday, 14 May 2011

Why isn't China happy to be Chinese?

The skyscraper littered skyline of Shanghai took me by surprise. With towering buildings, wide highways, and malls festooned with luxury brands, Shanghai is a veritable altar to consumer consumption. The city may not be representative of China as a whole, but it graphically demonstrates the increasing purchasing power of a burgeoning Chinese middle class.

I was in Shanghai for a friend’s wedding, and this was my first foray into mainland China. It’s one thing to read about the onward march of the middle kingdom, another thing to see it with your own eyes. There’s a real feeling of fortunes being made and empires being built around you. One can imagine the US a hundred years ago with the same no-holds barred mercantile zeal. For a communist country, China is one of the most capitalist places I’ve ever seen.

Before you all pack your bags and come rushing, I should warn you that although there’s money to be made, it’s unlikely to be you that’s making it directly. From my (albeit brief) discussions with people working here, you either need to be Chinese, or at the very least have strong understanding of the Chinese culture to survive in business here. There are plenty of expats successfully working for multinationals as employees, but no real sense of immigrant entrepreneurs making it big.

Two hundred years ago Europe was desperate for Chinese goods, yet had little to offer in exchange that China wanted. Now looking around Shanghai, almost all the luxury brands are Western, and almost all the models in the posters are caucasian. But looking at the shops, they certainly don’t seem to be full of expats or foreigners. Where once the Chinese looked down on western barbarian produce, now it seems they just can’t get enough. The best advantage for Western companies seems to rely on being Western.

From Shanghai we headed out to Beijing to do the usual sightseeing. From the Great Wall to the Forbidden city, and elsewhere, it’s noticeable that the majority of tourists appear to be domestic. Desire for Western products and lifestyle doesn’t seem to have dampened interest in their own ancient empire.

Gift hunting in the Beijing Silk Market proved to be an interesting experience. The name might conjure up visions of some dusty street market, but the modern day silk market is a 7 storey building with each floor crammed with stalls selling everything from silk to consumer electronics. Hawkers call to you as you weave amongst the shops, even physically grabbing you to draw your attention. Prices routinely start at ten times the going rate before the marathon negotiating begins. If I have one piece of advice to offer, it’s to never get too attached to any item in a shop. No matter what you’re looking at, there will be at least three other shops selling the same or very similar items. Be prepared to walk away if you don’t get the price you want.

I stepped into a stall selling silk scarves. After looking at a few, the saleswoman asked if I’d be interested in some “Hermès” scarves, pulling out a few to show me the label. I put it to her that it was rather obvious that these were not genuine Hermès scarves. She looked at me for a moment and gave me a knowing smile. “Chinese Hermès” she whispered conspiratorially. China has a long and illustrious tradition of making silk. Why not just sell me Chinese silk and be proud of it?

Fifteen minutes of negotiating later I emerged from the stall, proud possessor of some fine Chinese silk scarves. Well, as far as I can tell anyway. I’m told that the only surefire way of checking that a scarf is made of silk rather than polyester is to burn it and see how it reacts. The negotiation was hard enough without me trying to set fire to the merchandise.

The Silk Market is a great place if you want to buy knock-off western brands. There’s no shortage of LVMH bags, Ralph Lauren Polos and Mont Blanc pens. If you buy these brands in order to be seen with the little polo player on your chest, then by all means head on over. If you buy them in the belief that the marque guarantees a certain level of quality then you’re left in a bit of a quandry. It’s certainly possible that these come from the self same factories that make the “genuine” goods, but they probably don’t. Unless you’ve got a good eye for what you’re buying, it can be hard to tell.

While the Chinese government permits this kind of thing to go on freely and openly, Chinese made goods will continue to suffer from a reputation problem. However one only has to look south to the Foxconn factories producing high quality Apple iPhones to see that China is perfectly capable of matching any Western craftsmanship. Japan managed to successfully exchange a reputation for cheap and shoddy goods in the 50s for hi-tech and high quality in the 70s. Can China do the same whilst avoiding the fate of the Japanese economy in the 90s?

As the trip comes to an end, I’m left wondering - Why isn’t China happy to be Chinese? Perhaps it’s just a matter of time and soon enough we’ll all be buying western fakes of prestigious Chinese brands.

We certainly live in interesting times.

Saturday, 2 April 2011

GeeknRolla 2011

This Wednesday saw around 500 people descend on the Park Plaza Victoria for GeekNRolla 2011, Mike Butcher’s annual startup conference. Priced at £150 it’s significantly cheaper than most of the well known US conferences (or indeed Le Web), although it is on a smaller scale.

The event attracted some great speakers, including prolific angel investor Dave McClure giving his usual profanity riddled Startup Metrics for Pirates talk, Morten Lund delivering his unique brand of slightly unhinged inspirational advice and some great insights from Martin Varsavsky founder of FON.

Wendy Tan White took us through the rollercoaster ups and downs of running Moonfruit from 1999 to the present day, and a fireside chat (sans fireside) with Josh Williams of Gowalla revealed plans to open a London Gowalla office.

As usual with these events, you have to make a tradeoff between the panels/talks/pitches and talking to people in the lobbies and corridoors. I tried to see most of the speeches and pitches but skipped some of the panels.

Show me the money

In a surprise turn of events, DFJ Esprit decided to offer the winner of the pitching competition a £50k investment in the form of a convertible note priced on par with the next investment round. For those not familiar with venture finance, this is a pretty good offer, since it effectively means that DFJ are not being compensated for the early stage risk compared to a later stage investor - typically convertibles are priced at a discount to the next round.

It’s worth noting that taking seed capital from a VC does carry some signalling risk if they don’t follow on, and convertible notes have the disadvantage of giving the investor and the founders differing incentives for the pricing of the next round. However given DFJ’s reputation and partner Nic Brisbourne’s active involvement in the London startup community, I can’t imagine anyone turning down the offer.

Startups Pitching

I thought it would be interesting to take a look at the companies that were pitching. Each was given two minutes to pitch and then had a few questions from the judging panel:

Duedil (overall winner). Aggregating business information. A bit like CapitalIQ, but with the intention of providing end users access to company data for free. In their pitch they had a great example use case for consumers - verifying the credentials of a visa service before handing over your passport. Beyond this one can easily see many uses - small businesses running checks on customer or partners, competitive intelligence, investor research etc.

In the presentation they mentioned “Business Voyeurism”, and after playing around with the rather slick alpha-release product today, I can see exactly what they mean - it’s pretty addictive to just navigate around the details of companies and directors with such ease. Of course this data is all already publicly available from the likes of Companies House at low, but non-zero, cost through a slightly clunky interface, and so it’s the ease of use combined with zero cost and aggregation of multiple data sources that makes Duedil such a great product. The UI could still do with some tweaks, but it’s looking pretty good and I can see why they deserved to win the competition.

During the presentation they struggled to explain a concrete plan for monetization, and from speaking to them afterwards I think in part this stems from their strong drive for using Duedil as a tool to encourage transparency and hence always keep the basic product free to use. I’ve no doubt they’ll solve the monetization question in due course.

WireWax. Making video clickable. These guys have built an application that allows you to highlight hotspots in videos (like people or objects). The application will then track them through the video and allow end users to click on the tagged areas or hover over them for information. This can then be used to e.g. find out what clothes people are wearing and then click through to buy them. The product seemed to be fairly well developed and they already had ITV as a customer. A pretty good presentation and the questions from the panel seemed to focus on the fact that there were several competitors in this space.

ArtSpotter. Crowdsourced Art finding maps. An iphone app at the moment, presuamably with plans to move to other platforms if they get traction. Most impressive thing about this which the panel didn’t pick up on was that the founder got the app built for just £1500 (and didn’t develop it herself).

Frameblast (Clearer Partners). This one appeared to be a B2B marketplace for video production services. I say appeared to be since I’m not sure I fully understood the pitch. I suspect the presenter may have suffered a little from being deprived of the notes accompanying his slides. They seemed to have assembled a team with strong industry knowledge (ex-BBC and Joost), so I guess they know what they’re doing. Perhaps a case of the shoemaker's children going unshod? With a bit more polish I’m sure with their production background they can deliver a much better pitch.

PoraOra. Browser based 3D learning. Kids wander through a virtual world (MMORPG style) except instead of slaying each other or building virtual property empires, they solve sums and practice their spelling.

The graphics looked pretty slick and they had a nice marketing video which seemed to work well. PoraOra uses a virtual pet as the incentive mechansim - learn your times tables the pet gets healthier, mess up your negative numbers and Fido is off to the glue factory. The virtual pets following the kids around reminded me a little of the daemons in Phillip Pullman’s His Dark Materials, but I guess this game is aimed at a younger audience.

Education is a topic close to my heart, and Khan Academy has demonstrated the kinds of innovation that are now possible in the way we teach and learn, in particular giving learners control over their learning, and giving teachers/parents access to much more data and analytics than has ever been possible before.

The main concern raised by the panel was the question of how effective the game would be in keeping the attention of ADHD riddled kids. That’s a tough one to crack, but I guess there’s no reason why kids can’t play both PoraOra and Grand Theft Auto rather than picking one over the other.

TheSocialCV.com. Collects social information about people, runs some semantic analysis and compiles it into a unified profile. They mentioned it was in a similar space to the Salesforce acquired Jigsaw, and it also sounded similar to Qwerly (although it sounds like they do more semantic processing). Started as a research project with Google. From the name and the site, it appears the main focus is on using the application for recruiters.

Online social identity certainly seems to be an attractive market, which also means there are quite a few people competing in a similar space.

The biggest issue with the pitch seemed to be that they were pitching a product rather than a business but paradoxically they didn't really get to the product until about half way through the pitch. The demo when they showed it look pretty good, and would have been better to have this up front. They used a recorded demo from SXSW, but it would have been amazing if they could have run a demo based on the people currently at GeekNRolla.

Yearbook Machine. An yearbook creation service with a focus high quality design and good UX. Having been part of the team putting together a yearbook at grad school, I’m very familiar with the pains involved, and I can see the economics of this business making sense (spreading fixed costs over many customers etc).

Most of the panel’s questions were about competitors and the risks of general album/photobook printing services (like Blurb) moving into the yearbook space. However I suspect that if these guys have a slick product focussed on the Yearbook vertical, they should be fine and could possibly exit to one of the album publishers.

The presenter wore a yellow pocket square which was a nice touch. Not because the sartorial standards at GeekNRolla were lacking, but rather because little quirks like that make sure people remember you, and make you easy to find for anyone who has questions. Startup t-shirts work fine too in case you’re a bit rusty on pocket square folding techniques.

AreaNow. A mobile local nightlife app. Very offbeat presentation style and slides. There are quite a few people trying to solve the local events problem - maybe this team might manage to do it but it’s not immediately obvious how.

Qublus. Indoor positioning based on radio signals. Didn’t go into details about their technology, but said it works better than GPS or Wifi triangulation indoors. You need to map the building before you can use it, but then the end users just require a mobile app on their phone. They've built a mall app in Sweeden already. Certainly intruiging - if the technology is as good as claimed this could have a number of applications, including delivery of hyperlocal advertising in places like Westfield.

FlyPost. Turning distressed events into deals (e.g. groupon for unsold local ticket inventory). Simple and to the point presentation. Bringing effective yield management to local businesses is something that GroupOn defintely have in their sights, and there are several people competing in the ticketing space, however nobody really seems to have cracked this one yet, so plenty of opportunity.

One issue raised by the panel is the problem of adverse selection - the only tickets sold on this service will be undesirable ones that haven’t already sold. While this is certainly true, there’s a certain underlying assumption in the question that all tickets have the same utility for all customers, which isn't true. Thus just because most people don’t want to go see Justin Bieber in concert next Saturday in Slough, doesn’t mean other people wouldn't were they made aware of the opportunity at a low enough price.

MarketInvoice. Pitched as working capital financing for SMEs, but essentially a marketplace for factoring invoices. From the questions and answers it seems that they take care of grouping together the debts in tranches and also syndicating them amongst investors. Not sure where the responsibility for assessing the credit risk lies, but seems like a classic internet disintermediation play like Zopa. The main question seems to be whether there are enough businesses interested in joining as factors.

Art finder. An art discovery and sharing site. They also produce a collection of ipad apps in the style of coffee table books along with print on demand artwork. A new take on presenting art - seemed to be well put together and I guess the only questions are really around who else is competing in the same space. If Artfinder can build a strong database of art and form partnerships with museums and artists, then they should be in a pretty good position.

Updates and a tip for future

There were also updates from BraveNewTalent, Conversocial, GroupSpaces and Qwerly who all seem to be making great progress one year on from the last GeeknRolla. Special mention has to go to Max Neiderdoerfer for the most hilarious (yet informative) presentation featuring the Rageguy.

All in all a great conference, and a great place to launch a startup. The one thing I’d recommend to anyone pitching is to make sure you’re early on in the running. By the time the later pitches occurred the room was more than half empty, and in particular the last few were in the dreaded just-before-lunch slot. Might be worth re-arranging the pitches to put half in the afternoon instead to make it a little fairer.

Sunday, 27 February 2011

Product Camp London

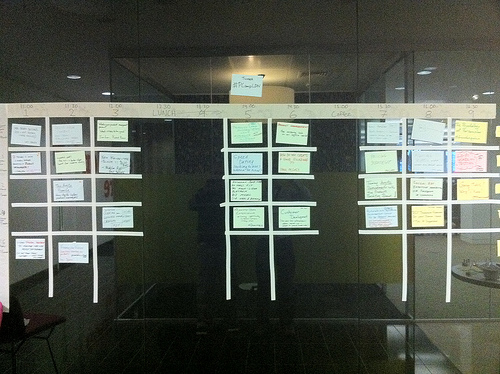

I spent most of yesterday at Product Camp London, hosted at the expectedly trendy offices of The Guardian. Product Camp is an unconference focussing on product management and marketing. For those not familiar with the format, an unconference is a participant-generated conference where those attending the conference sign up to give the talks. These can be organised in various ways, but Product Camp took a simple approach with a blank timetable on the wall with around 4 streams and 9 timeslots where people stuck post-it notes with sessions they wanted to run.

|

| http://www.flickr.com/photos/simoncast/5481722709/ |

The product focus is predominantly on software and web based products (at least nobody I spoke to was building a dual cyclone vacuum cleaner in their shed), and the skew seemed to tend towards the startup end of the market rather than more established companies.

It's great to see these kind of community organised events in London, and judging by the adhoc job-board which sprung up, there's strong demand for good product people which is hopefully a good indicator of tech company growth.

I only arrived halfway through the event, so unfortunately missed the morning sessions, but to give you a flavour of the talks, the ones I attended were

- Software tools and multi-sided markets. This one turned out not really to be about multi-sided markets at all, but was an interesting discussion on marketing products where the end user and buyer may be different people (as is the case in many enterprise sales)

- Customer Development. A quick overview of the classic Steve Blank startup philosophy given by Salim Virani of Lean Camp fame along with some group discussion about how it could it be applied in practice.

- Product Pricing. A talk by Paul Lomax of Dennis Publishing looking at ways in which pricing tactics like decoy prices and bundling can change consumer buying behaviour. Had there been more time it would have been useful to take a quick look at some of the underlying mirco-economic principles like consumer surplus and price discrimination, but it was a good talk with some great input from the audience. This one ended up winning the prize for the best session of the day.

- Social Advertising. A look into how to advertise on social networks along with discussion about what does and doesn't work. The good thing about this one was that it discussed real numbers for CTRs, CPCs etc. (this one was given by my brother so I may be biased...)

- Psychology of Persuasion. Covering the basics of various persuasive techniques that can be used in marketing products (reciprocity, social proof etc). Some overlap with the pricing talk, but I guess that can't be avoided in an unconference.

As with most of these events, many of the interesting discussions happened outside the main sessions, in the coffee breaks, lunch and the Google-sponsored drinks afterwards. The format worked well, and hosting it on a Saturday ensured a certain level of self-selection regarding interest in product management and marketing.

Overall a great event and a great job by the organizers in pulling this together.

Friday, 14 January 2011

Coadec Panel - Government and the Digital Economy

On Wednesday night Techhub hosted a panel discussion organised by Coadec on government and the digital economy. No doubt the video will be up somewhere soon enough, but in the meantime here's a quick summary with some thoughts.

Big Apple, Big Smoke, Big Taxes

Several perennial issues came up such as taxation and shortages of skilled labour. More interestingly, the debate moved from the endlessly rehashed Europe vs The Valley to London vs New York, which is a much more useful comparison. Looking at the east coast of the US we can probably pick up a few tips on how startups and tech firms can compete for labour with the finance sector. On the subject of New York, Sean Senton-Rogers of PROfounders Capital noted that once you take into account all the relevant taxes, startups actually pay more tax in New York than London. Similarly it was mentioned that Dublin's low corporate tax doesn't really make much difference to startups (and presumably is done to favour larger companies who are considering expanding to Europe).

Too busy to care about government

On the topic of the hastily enacted digital economy bill, Wendy Tan of Moonfruit highlighted that most startups are so focussed on minding the shop (quite sensibly) that they don't have time to consider government policy making. This is a particular problem when their interests may not be aligned with those with more lobbying firepower. Tory MP David Davis suggested that this doesn't mean that startups should get together to hire expensive lobbyists, but rather that they need to become more effective communicators. I'd be curious to see how this is handled in the US - can early stage startups abdicate this responsibility to VCs and grown-up startups like Google? Sean suggested that individual VC firms could do more, rather than relying on the BVCA, although one would assume government lobbying is one of the main reasons for the BVCA's existence.

The opposite of Dr Beeching

Regarding the thorny topic of net neutrality, David Davis made the observation that were we to have huge oversupply of broadband, we could make it a moot point. A few tweeters wondered how this could be reconciled with small government, but I'm not sure this is a huge issue. There's a big difference between governmental nudges to push infrastructure in the right direction and wholesale nationalisation as suggested by someone in the audience. If the marginal cost of increased bandwidth is relatively low, then this doesn't seem like a bad idea, although it carries the risk of the overcapacity being rendered obsolete by new innovations.

Politics 101

It was good to see two MPs that seemed to have a decent handle on tech affairs, and they made the point that if you want politicians to educate themselves on an issue, then the best way to do that is to make it an election issue. This presumably is the House of Commons equivalent of the classic schoolboy "Sir, will this be on the exam?"

Focus, Daniel-San

Overall a worthwhile way to spend a few hours, with a good turnout. The panel was probably a little too large to allow for proper discussion, but I'd be hard pushed to say who should have been dropped. Perhaps an event more focussed on a single issue might be an option for any future sessions.

Wednesday, 5 January 2011

Government and Startups: Financing

How can the UK government help with startup financing?

London co-working space Techhub recently hosted an event featuring a Q&A with government minister David Willets on the topic of how the government can help the local tech startup community. Several interesting points were raised, but the two main issues seemed to revolve around finance and labour. In this post I’m going to focus on startup finance and I'll do another one later with thoughts on labour issues.

All businesses need capital in order to function - both seed capital to get going, and further capital to grow. Broadly, this capital can take three forms, and the government can assist with all three.

1. Debt Financing

There was some discussion during the event about how banks weren't lending to startups. It’s important to understand that banks aren't generally in the business of risky financing (relative to equity). Banks will only lend where there is reasonable expectation that the borrower will be able to meet the repayments schedule. This normally means either stable cashflows or reliable outstanding receivables. They will often want personal guarantees or collateral.

The Silicon Valley Bank coming to London is good news - they’re a bank which knows how to deal with startups, and will no doubt make life a bit easier as well as encouraging other banks to up their game. But ultimately they are a bank with exactly the same fiduciary duties as any other bank - they're not going to be handing out credit like candy.

Debt financing may also come in the form of loans from friends and family. I'm not sure structuring this kind of financing as debt is a particularly great idea since most likely they’re taking on quite a lot of risk for limited upside, and so it's a better deal to offer them equity. However some might prefer the simplicity of a loan.

How the goverment can help: In truth I think there’s not a lot the government can (or should) do to interfere with bank lending procedures. Schemes like the Enterprise Finance Guarantee are a useful short term measure for a tight economic climate, but will only help those on the margins of lending decisions.

2. Equity financing

For the vast majority of startups, equity financing is the most important source of capital. Equity investors will usually specialize by sector and investment stage depending on the level of risk they are willing to take. Early stage investment will usually always be riskier than later stage.

Equity finance might come from individuals (business angels, friends etc) or from institutions such as VC funds.

How the goverment can help: As with debt finance, it's not the government's job to change investment criteria or decide which individual businesses should get investment. However there are at least two ways the government can increase the total quantity of equity capital available for early stage ventures -

a.) Capital Gains Tax. The presence of taxation skews the risk-reward curve, since it affects the ultimate cash return from the investment. By reducing capital gains tax investors get higher returns for the same level of risk.

b.) Increasing the supply of capital directly. The best way to do this is to invest alongside outside investors with an existing fund manager. This is exactly what ECFs are designed to do. It would be great to see some top tier VCs participating in this program. David Willets promised to come back for a second session with somebody involved with the ECFs in January, so keep an eye out for this. In particular it will be interesting to see what the minimum investment amounts are for these funds and how they can balance that with attracting the best fund managers.

3. Internal Financing

Finally, the best kind of financing is from customers (i.e. from revenues). Typically most startups will not be able to make enough from this source to fund high speed growth, but we shouldn't ignore this as an source of finance.

How the government can help: Buying from startups. This includes making startups aware of opportunities to bid for government work, and also the “competition prize” model for innovative solutions as with the Technology Strategy Board.

Should the government help with startup finance?

We've addressed some of the things the government could do to assist startups. Whether they should do these things or not is more difficult question. Some will carry a financial cost (like reducing CGT), which may not lead to an immediately measurable return. Every pound spent in this way is a pound that could be spent on more established industries, the NHS, education etc and is ultimately a policy decision for the government.

In addition to the usual government capital allocation problem, any situation in which a the government is directly injecting cash into startups risks crowding out private investment and ultimately weakening the ecosystem. This kind of intervention only makes sense where there is market failure, and it's not immediately clear that this is the case.

Saturday, 1 January 2011

Charity begins at Startup

|

| http://dilbert.com/strips/comic/1996-01-16/ |

It's a worthwhile read if you look past the occasional veneer of self-promotion, and one of the things that caught my attention was the chapter on corporate philanthropy. Charitable giving by corporations can be a tricky topic; while the end goals are usually very worthwhile, it can be hard to avoid the image of a company reaching into shareholder pockets to donate money on their behalf.

In general, corporate giving (in cash or kind), like any corporate spending, should only be done where it results in a return greater than could be achieved by a shareholder donating the money themselves. There are many cases where this is true and results in value creation.

The problem with corporate social responsibility programmes is that they can often seem like a bolt-on or afterthought on the part of the company. Salesforce took an interesting approach by insisting that giving back to the community be embedded in the DNA of the company from the outset. In particular, Marc Benioff and his co-founders created a charitable foundation at the same time as incorporating their company, and donated 1% of their equity to the foundation.

I love the simplicity of this idea - it requires no cash outflow and ensures that the foundation's endowment grows alongside the company.

I'm not necessarily suggesting that all startups follow the foundation-on-foundation idea. In most cases it's probably not worth the paperwork until you're making real money. But it would be a simple thing for startup founders to agree in principle to set aside a small chunk of equity for for a foundation, much as they would with an employee option pool. Alongside agreeing to set aside this equity, it would be prudent for the founders to decide on the guiding goals of the foundation.

In addition to the initial 1% equity, Salesforce also donates 1% of employee time and 1% of profits (in the form of software discounts to charities). They also took the quite unusual step of moving all their education and large NGO customers to the foundation, providing the foundation with a sustainable income stream.

A big advantage of baking corporate philanthropy into the core of a startup from day one is that all employees and investors know what they're getting into up front. Is this likely to put off some investors? Possibly. But as long as appropriate safeguards are in place (regarding rules on profitability), it may even attract investors that are better aligned with your own goals.

Subscribe to:

Comments (Atom)